Our Services

We work with our clients on a Retainer basis. We offer a limited number of Financial Jump Start meetings for young professionals.

Financial Jump Start

We are currently not scheduling Financial Jump Start meetings. We apologize for any inconvenience.

The Financial Jump Start is a one-time, two-and-a-half hour planning session where we answer your top three burning questions. The purpose of this meeting is to jump start the conversation about your financial wellbeing. This meeting is not designed to provide a comprehensive financial plan or a revamp of your investments. A Financial Jump Start costs $1,500.

Financial Jump Start Includes:

- Specific written recommendations and analysis.

- Follow-up by telephone or email for 30 days after the meeting.

If you would like to schedule a Financial Jump Start, please call or email our office. Please complete our Personal Profile Questionnaire and send us the items listed on the last page of the Questionnaire two weeks before your Financial Jump Start meeting.

Retainer

We are currently not accepting new Retainer clients. We apologize for any inconvenience.

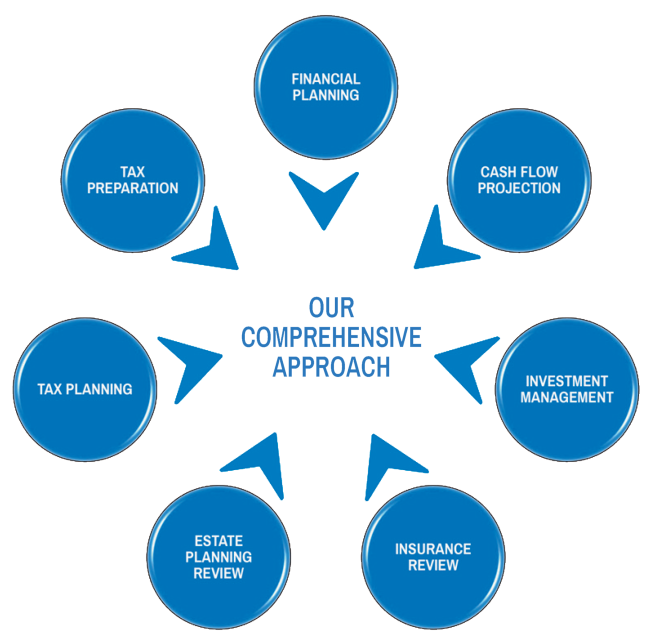

We develop a comprehensive financial plan for all our Retainer Clients and do ongoing implementation for your plan. It’s like having a personal trainer help you achieve your financial goals! Our services include Financial Planning, Cash Flow Projection, Investment Management, Insurance Review, Estate Planning Review, Tax Planning and Tax Preparation.

We typically meet our Retainer clients three times a year – once at tax time, once in the Summer for Investment Review and once in the Fall for Tax Planning. Clients can schedule additional meetings as needed. We can meet our clients in-person or remotely and our clients have unlimited email and phone access throughout the year.

Financial Planning

We assist our client to set attainable short-term and long-term goals based on their vision for lifetime success and happiness. We advise on any topics related to your finances including but not limited to college planning, student loans, new home purchase, employee benefits and small business planning.

Retirement and Cash Flow Projection

We analyze your cash flow, savings and goals to determine income and expenses in retirement. We run projections for multiple scenarios to consider various retirement options and lifestyle choices. We discuss Social Security strategies and Medicare options to help you make informed decisions. When appropriate, we assist with downsizing your primary home and navigating Retirement Community options.

Investments & Asset Allocation

We examine your current investments to ensure they are appropriate for your risk tolerance, your tax bracket and your long-term goals. We rebalance your investments to hedge against extreme economic cycles. Diversification appropriate to your investment horizon can enable you to reduce portfolio risk while substantially enhancing your return on investments.

Insurance Review

We review your insurance needs, including health, life, disability, property and long-term care insurance. We assess current coverage and deductibles, as well as examine policies before you purchase them.

Estate Planning

We help you think through how you want your loved ones taken care of and your assets divided, with emphasis on streamlining your plan and reducing probate costs.

We assist with gifting strategies for children and grandchildren as well as tax-efficient charitable donation strategies.

Tax Planning and Preparation

We prepare your personal tax returns and provide you with professional advice year-round. We update and educate our clients on tax law changes. Our tax planning advice and strategies often save money for our clients.